With the development of China's capital market, the securities industry has also maintained steady growth. In 2020, when various industries are affected by the new crown epidemic, the industry will still perform well and accelerate its online development. Traditional brokerages rely on longer development time and brand reputation is still the mainstream of the market, but in recent years, residents' investment and financial management have become more diversified, and they have more access to Hong Kong and US stock market stock transactions. At the same time, more companies are listed in overseas markets, and more market-oriented companies are needed. Provide institutional services such as investment banking and ESOP. Therefore, pure Internet brokerage companies with Hong Kong and US stocks as their main service markets have broad room for development, and their status will be improved in the future.

The article analyzes the overall environment, users and industry conditions, and discusses development trends and development strategies.

Environmental Analysis

1. Macro trends in the financial industry

Politics

The domestic supervision of the financial industry is strict, and the profits of emerging companies cannot meet the needs of domestic listing;

Gradually relax restrictions on the business scope of foreign-funded financial institutions, and foreign-funded securities firms can obtain licenses with a more comprehensive business scope.

Economy

The wealth level of Chinese residents continues to grow, and the amount of investment available to Chinese people worldwide has increased year by year;

With the continuous development of the global economy and the continuous innovation of financial markets, a large number of individual investors have entered the market.

Society

With the growth of GDP, residents' wealth management needs will increase accordingly;

Since the new crown epidemic, the scale of online transactions by users has continued to expand.

Technology

Technologies represented by big data, cloud computing, artificial intelligence, etc. make traditional securities business more convenient, intelligent and differentiated;

With the advent of the 5G era, the securities business model will be further reconstructed to achieve wider inclusiveness and accessibility.

2. Market scale & development trend

Securities industry

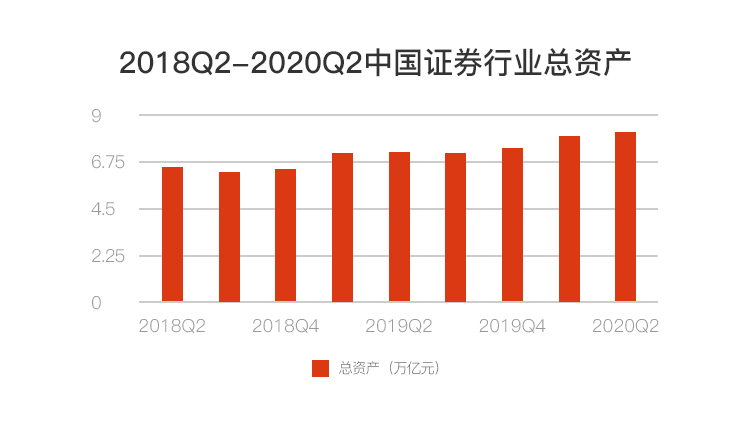

From 2018 to 2020, the total asset scale of China's securities industry has continued to expand. Even under the influence of the new crown epidemic, there is still a stable performance.

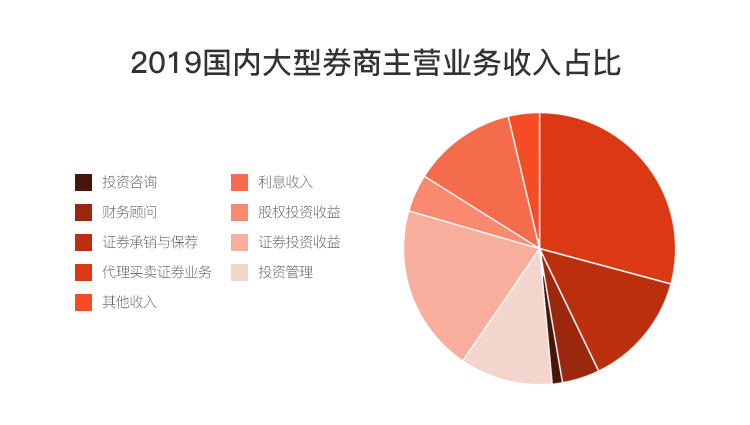

With the gradual saturation of the traditional business market and the decline in commission rates, securities companies have begun to develop in the direction of diversification and high quality. The main income structure of Internet brokers is gradually shifting from handling fees to interest income.

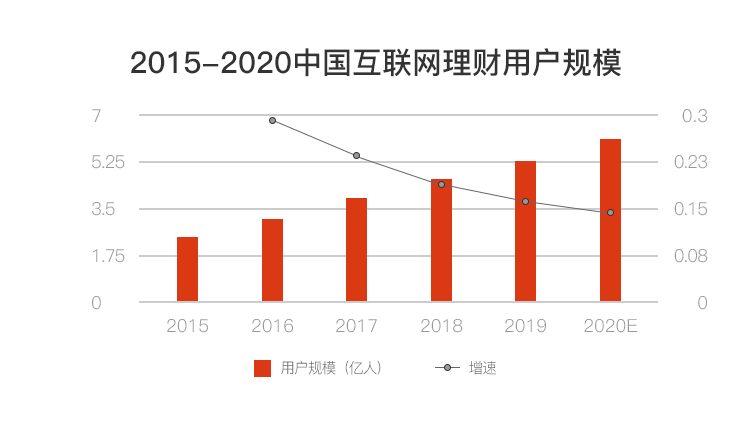

Internet broker

The number of Internet wealth management users continues to grow, the degree of "online" in the securities industry continues to increase, and the functions of the entity business department are gradually weakening. Internet brokers are subverting the service model of the traditional financial industry by virtue of high efficiency, low cost and friendly user experience.

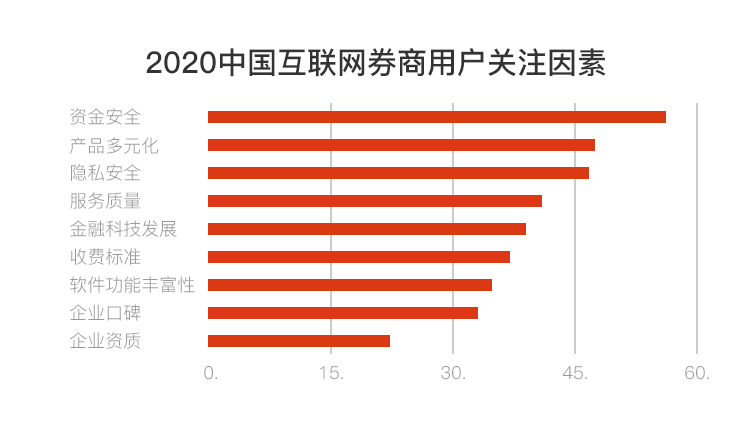

Internet brokerage users are most concerned about the safety of funds and privacy, followed by product diversification. Internet brokers need to make more efforts in building reputation and improving product stability.

User analysis

1. Internet Securities Industry-Classification & Attributes

In recent years, with the continuous opening up of China's securities industry, Internet giants have entered the securities field by investing in securities companies, and the participation of large commercial banks, insurance companies and other financial institutions in the securities industry has also continued to increase. With their advantages in financial strength, customer resources, and Internet technology capabilities, these Internet brokers will pose a competitive threat to Chinese securities companies. The competitive landscape of the securities industry shows a trend of centralization and differentiation, and industry integration is accelerating.

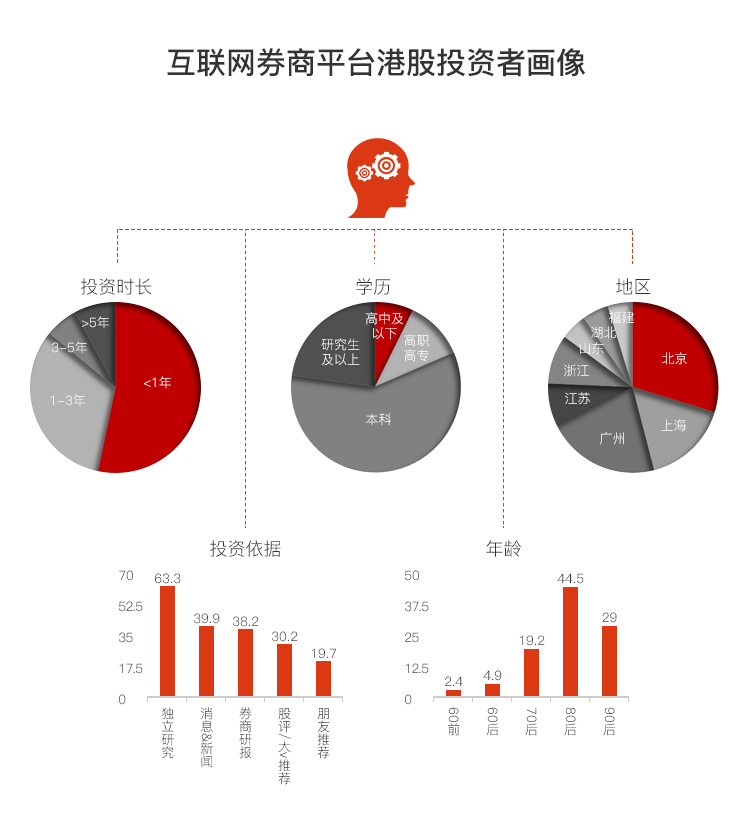

2. Portraits of Hong Kong stock investors on Internet brokerage platforms

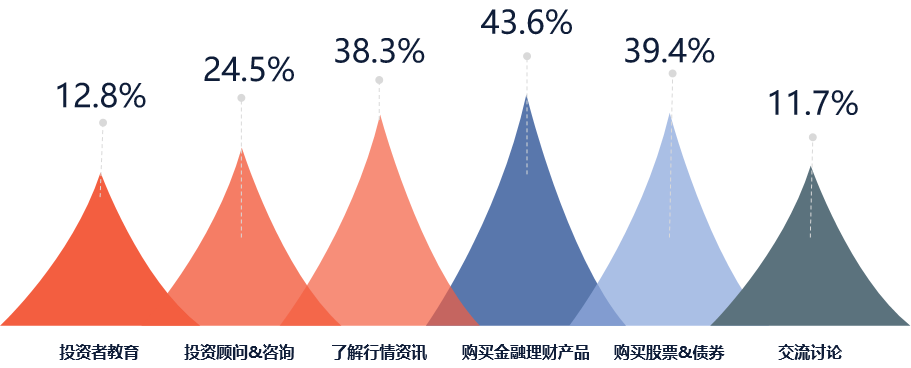

3. User needs of Internet brokers

The user's use of Internet securities products is still mainly to meet the core transaction needs. Compared with traditional offline business halls, Internet securities companies can integrate information, education and other content through online channels, and publish through platforms and establish discussion communities to further attract users other than trading users, enhance user stickiness and realize users Conversion.

In addition, due to the lack of opportunities for offline communication with users to establish trust, the industry's top brands have more obvious advantages in word-of-mouth and user numbers, which will have greater appeal to retail investors.

![]()

Industry analysis

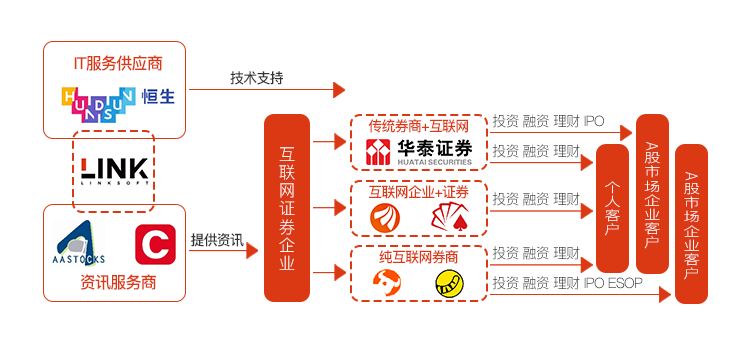

1. Link's position in the industry chain of Internet brokers

Link plays the role of IT service provider in the industry chain of Internet brokerage firms. The company's development is closely related to the development of Internet brokerage firms. The continued prosperity of the securities industry has prompted the downstream brokers to increase their demand for high-quality IT technical services. Link, as an IT service provider, is in the competitive landscape of the financial IT industry. Its direct competitors are other financial technology solution providers in the financial IT industry.

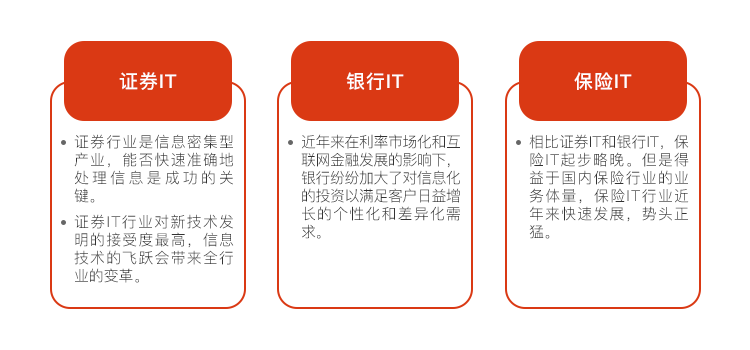

2. Financial IT Industry-Classification & Attributes

Financial IT is a sub-industry of financial technology. According to different types of downstream customers, it can be subdivided into securities IT, bank IT, and insurance IT. The financial IT industry has high entry barriers, strong customer stickiness, and obvious first-mover advantages. It is difficult to shake the leading company's position. With the in-depth application of emerging technologies such as cloud computing, big data, artificial intelligence and blockchain in the financial industry, the role of technology in finance has been continuously strengthened, and the development of innovative technologies is expected to further break the industry ceiling and bring new opportunities to the market .

Development trend

1. The development trend of financial IT industry

Core trend: symbiotic growth; blurred boundaries and gradual integration

Under the influence of Moore's Law, the modern financial system is experiencing exponential growth

Under the action of Moore's Law, the computing speed of information technology and the speed of innovation of new technologies continue to accelerate, and the symbiotic growth of finance and technology has also made the modern financial system experience exponential growth along with information technology. The duration of each financial stage is getting shorter and shorter, and the innovation rate of financial technology is getting faster and faster. For financial practitioners and financial supervision, the development of financial technology in the new era is full of opportunities and challenges.

China's immature financial market gives soil for the rapid development of financial technology

Compared with developed countries such as Europe and the United States, my country's financial foundation is much weaker, but it is the immature feature of my country's financial market that has given my country the soil for the rapid development of financial technology. From the perspective of the distribution of global financial technology investment, in 2014, the financing scale of Chinese financial technology companies only accounted for 3.1% of the world's total, but by 2018, the financing scale of Chinese financial technology companies has accounted for 16.4% of the world's total, and the growth rate far exceeds that of Europe and the United States.

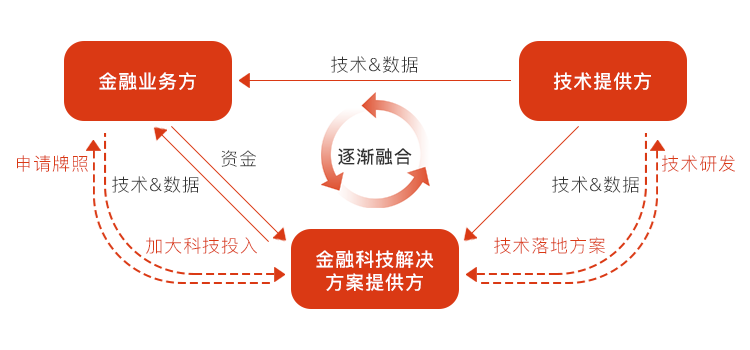

Financial companies and technology companies no longer have a clear distinction

The boundaries of financial industry participants are becoming increasingly blurred. Technology providers are working hard to make up for the shortcomings of financial business capabilities and provide financial institutions with technology upgrade services from single technology to overall business; financial technology solution providers are strengthening the research and development of cutting-edge technology on the one hand, and applying for financial licenses on the other hand. In the financial business and technology, efforts are made; and the financial business is increasing investment in cutting-edge technology research and development, and some leading financial institutions have launched technology export services for the same industry.

Development Strategy

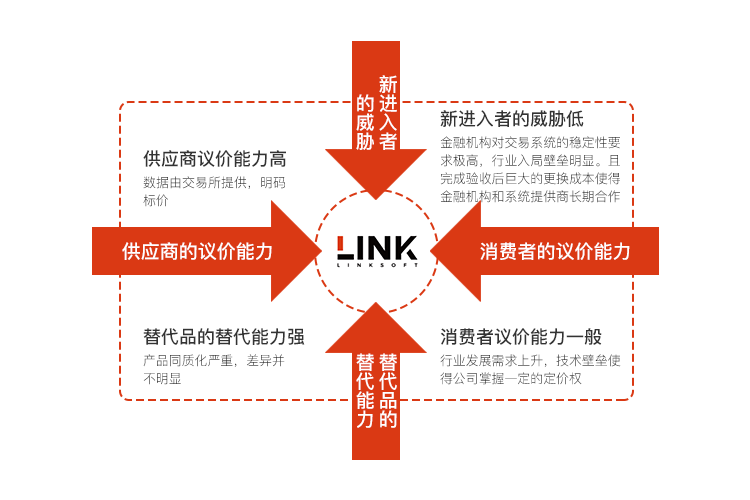

1. Porter's five forces model analysis-the intensity of competition in the financial IT industry

2. LINKSOFT's competitive advantage and development direction-TOWS matrix